Lots Of Inputs But Only One Real Focal Point

So many inputs, so little time for a Monday morning market missive. For example, there is a new record for the S&P 500. A new record for the amount of global debt sporting negative yields (now $13 trillion according to Barron's). A new approach for many of the world's central bankers. A new reason to buy gold. A new cryptocurrency play from our friends at Facebook (FB). A not-so-new geopolitical skirmish that is clearly heating up. New expectations for the trade war with China. And of course, a host of new economic data to consider.

The news flow is enough to drive global macro analysts crazy. Again, so many inputs, so many permutations to consider. And so many different ways to play.

However, from my seat, the bottom line here is pretty straightforward. If traders have learned anything over the last decade, it is that when the world's central bankers are all singing the same dovish song, the refrain for market participants becomes, "Happy days are here again." I.E. Risk assets tend to rise and bond yields tend to fall as stocks discount better days ahead and bond traders fall all over themselves to buy bonds.

Rarely has the message from central bankers been so clear, or so universal. Which, of course, makes the appropriate trading decisions a bit simpler.

Super Mario's Last Hurrah

Mario Draghi kicked things off last week by reinvigorating his now famous "whatever it takes" message from a few years back. More specifically, the ECB President said, "We have our mandate... We are ready to use all instruments that are necessary to fulfill the mandate."

In case your Fed-speak is a little rusty, Mr. Draghi basically said Tuesday that the ECB would be looking at taking action "commensurate to the severity of the risk" to the economic outlook. The ECB's "tools" being considered here include (a) extending the time frame before the next interest-rate increase, (b) a cut to the already negative policy rates, or (c) initiating another round of bond buying (QE).

In response, global bond yields continued their dive. This time though, the move might be more about getting into bonds before the next round of QE buying starts. Something former PIMCO "Bond King" Bill Gross referred to as "shaking hands with the government" (I.E. buying what the government is buying, before the government starts buying).

CNBC's Kelly Evans had an interesting take/rant on the subject as she wrote Wednesday, "Yields on global sovereign debt are now so low they barely qualify as "yields" anymore. Both France and Portugal saw their ten-year bond yields immediately fall to zero. Zero!!! For Portugal!!! Remember the PIIGS?! (Portugal's 10-year yielded 16.5% seven years ago.) Germany saw its 10-year yield plunge to -0.3%, a fresh low. Stunning.

The Fed's 180

Here at home, Jerome Powell followed suit Wednesday by providing a message to the markets that was as dovish as could be without actually cutting rates (a move that virtually nobody expected to happen).

The WSJ's Greg Ip summed it up nicely by writing, "Chairman Jerome Powell said the Fed was prepared to react aggressively to any weakness, drawing from research that says when rates are historically low, officials should move faster and sooner because they have less room to cut."

It's that last part that is important. You see, the Fed has historically been slow to act and has often been accused of being behind the curve. This is what a "data dependent" approach tends to produce, as much of the data is rear-view mirror stuff. And in my opinion, this is at least part of the reason for the stock market freak-out we saw last December.

So, in an effort to make things clear (perhaps as in "crystal clear") Powell said, "An ounce of prevention is worth a pound of cure."

In essence, Powell appears to have laid the groundwork for an "insurance cut," which would allow the FOMC to get the fed funds rate in line with market rates. To review, the Government's two-year note, which is viewed as being the most sensitive to Fed expectations, closed Thursday at 1.73%, which is the lowest level seen since late 2017, and more than 50 basis points below the current fed funds range of 2.25% to 2.50%. As such, the fed funds rate is currently out of line with the market.

The big takeaway here is that the Fed has continued to pivot away from its hawkish stance of seven months ago. First, Powell &P Company decided to become "patient," implying they wouldn't raise rates until/unless the data warranted. And now, they've done a complete 180 by suggesting that a rate cut is on tap as soon as next month.

What About China?

What about the trade deal, you ask? Isn't a truce in the trade war supposed to make everything all better again? My take is that if a deal with China doesn't happen, the "insurance cut" becomes a certainty and maybe even bigger than expected. For example, the Fed could buy by 50 basis points in July -or- cut by 25 and end the "runoff" program early. We'll see.

The Takeaway

To be sure, the debates over the trade deal and Fed moves will rage on in the coming week. But for me, the key is that traders of all shapes and sizes know what to do when the global central bankers cut rates. Buy 'em!

So, for now, at least, my take is that the stock market once again has a central banker tailwind blowing at its back. This usually means that the path of least resistance is higher and that the dips should be bought.

The State of My Favorite Big-Picture Market Models

Make no mistake about it; this remains a news-driven environment. As such, it is important to recognize that there is no way to effectively "model" the environment. The good news is with the Fed's 180-degree pivot now nearly complete, market participants are looking beyond the uncertainties and to the improving conditions that lower rates have historically meant to the market.

This week's mean percentage score of my 6 favorite models pulled back to 62.9% from 65.4% last week (Prior readings: 62.9%, 60%, 60%, 72.5%, 81.1%, 83.9%) while the median also slipped to 66.3% versus 71.3% last week (Prior readings: 68.8%, 62.5%, 62.5%, 80.0% 82.5%, 86.7%, 86.7%).

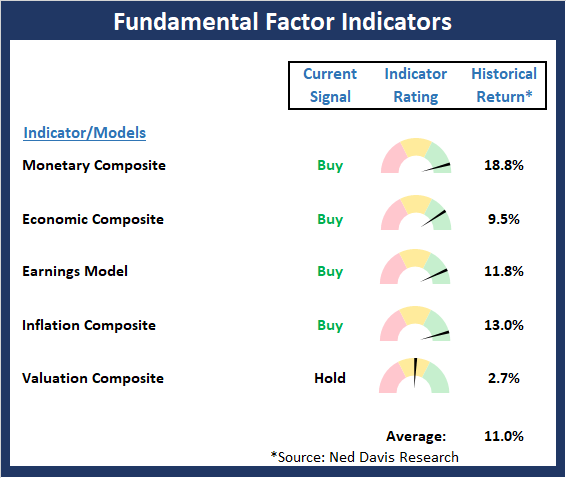

The State of the Fundamental Backdrop

Once again, there were no changes to the Fundamental Factors board this week. As I've been saying for some time now, I continue to believe the Fundamental backdrop remains constructive and favors the bulls.

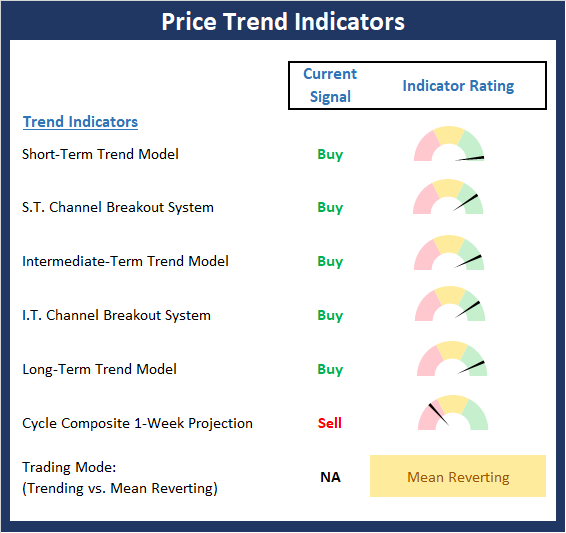

The State of the Trend

After consolidating the week prior, the Dow and S&P 500 stepped lively to new all-time highs on the back of the Fed suggesting, in a manner only central bankers can, that a rate cut is likely on the way. As expected, the move in the major blue-chip indices pushed the majority of the indicators on the trend board into the green. The only nagging red is the cycle composite reading, which is negative for next week, but then returns to positive for much of the next month.

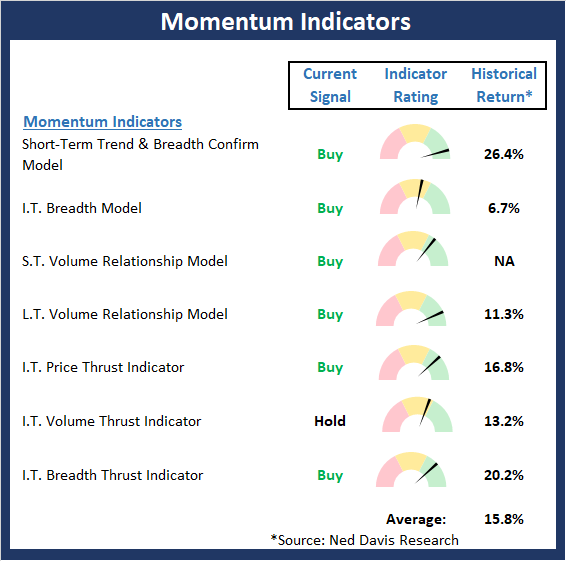

The State of Internal Momentum

What a difference a week can make in the indicator world. Last week, I opined that the Momentum Board looked a little sloppy. However, this week, there is an abundance of green and not a single sell-signal. And with the historical return average well above the mean, the odds favor the bulls and the dips should be bought.

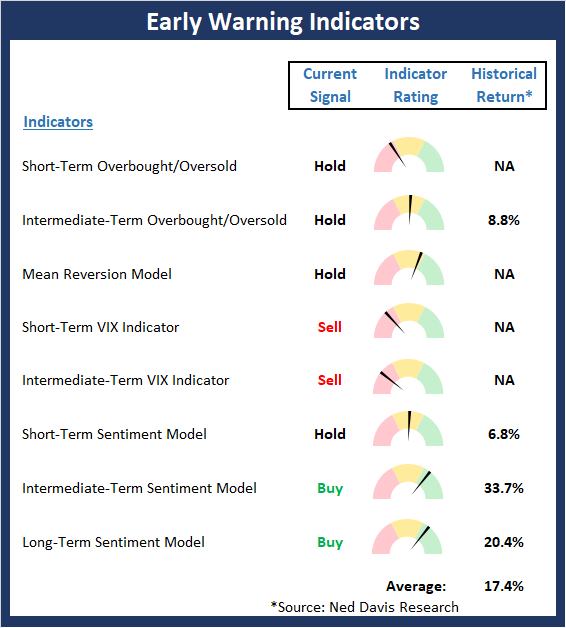

The State of the "Trade"

The Early Warning board appears to be in a state of transition. Whereas the board did a nice job of signalling that the table had been set for the bulls a few weeks back, it now appears to be moving in the opposite direction. Although the board is largely neutral at this time, the oscillators are swinging toward a decent bearish "set-up" at this time.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more